unified estate tax credit 2019

Act supersedes Real Estate License Act of 1983. 15000 per person per person.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Any tax due is determined after applying a credit based on an applicable exclusion amount.

. The trust is structured so that upon the death of the investor. The current exemption doubled under the Tax Cuts. Gifts have been taxed since 1924 and in 1976 Congress enacted the generation-skipping transfer GST tax and linked all three taxes into a unified estate and gift tax.

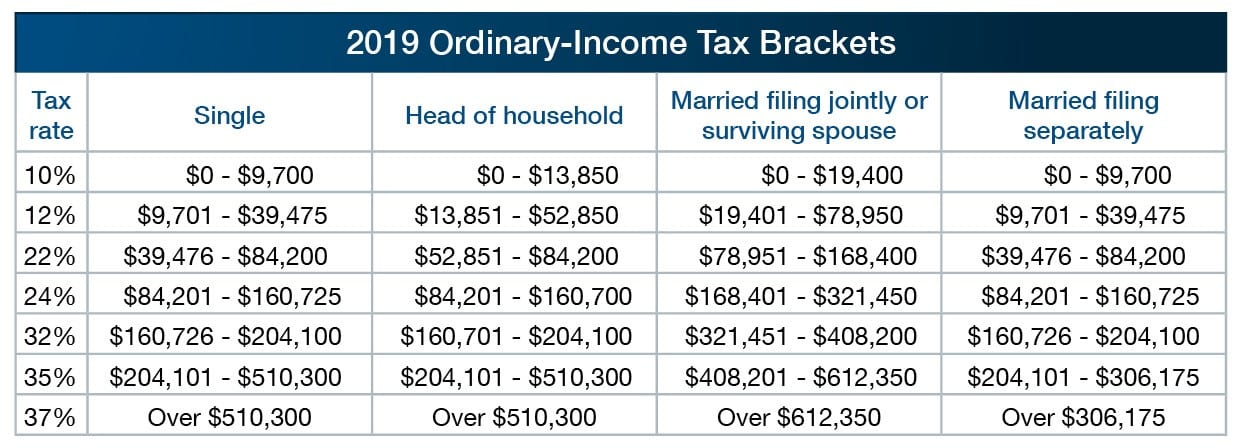

History of Federal Estate Tax Laws The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006. The exemption continued to increase annually until it matched the federal estate tax exemption in 2019. 2019 114 million 40 2020 1158 million 40 2021 117 million.

A key component of this exclusion is the basic exclusion amount BEA. Annual Exclusion for Gifts. Your estate must file an estate tax return to let the Internal Revenue Service know that youre making this transfer even though no taxes are due.

The estate tax is part of the federal unified gift and estate tax in the United States. The tax is then reduced by the available unified credit. BO tax credit for property tax paid by an aluminum smelter.

The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. Credit Shelter Trust - CST. The other part of the system.

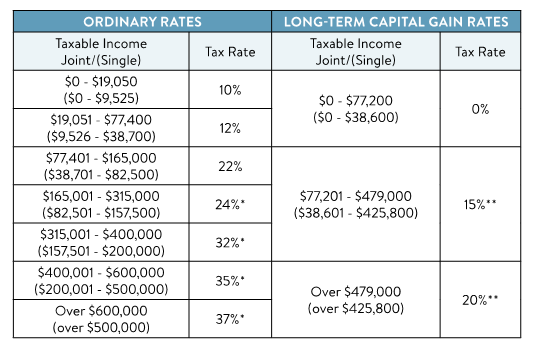

The Estate Tax is a tax on your right to transfer property at your death. The Gift Tax Annual Exclusion remained the same between 2018 and 2019. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly.

Is added to this number and the tax is computed. There is a federal gift and estate tax. The tax applies only to the portion of the estates value that exceeds an exemption level.

Fortunately the estate tax credit creates an amount you can pass on to your heirs without being taxed. The unified credit is equal to The amount that can be excluded for decedents dying on or after January 1 2019 is 50 million. Most every American taxpayer receives a lifetime credit against federal gift and estate tax of 12060000.

For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. To the extent that any credit remains at death it is applied against the estate tax. The tax is a unified tax.

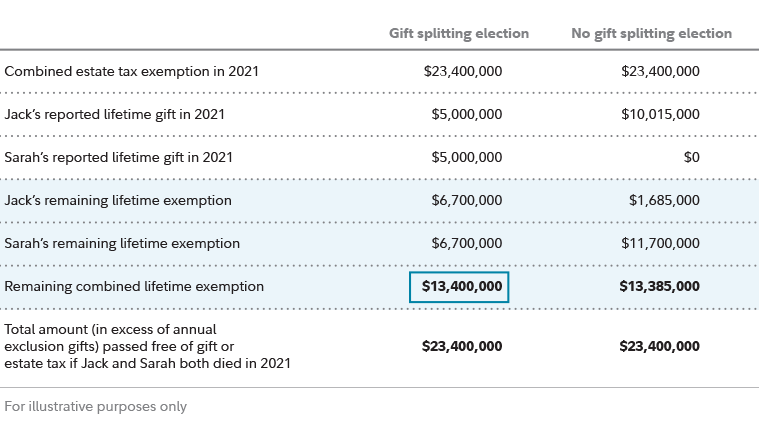

Certain gifts that you make during your lifetime reduce the amount your estate can pass free of estate tax. We would like to show you a description here but the site wont allow us. The United States has taxed the estates of decedents since 1916.

The credit is first applied against the gift tax as taxable gifts are made. It also served to reunify the estate tax credit aka exemption equivalent with the federal gift tax credit aka exemption equivalent. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019.

Generally fiscal domicile under such treaties is defined by reference to domicile as opposed to tax residence. A type of trust that allows a married investor to avoid estate taxes when passing assets on to heirs. Inheritance tax treaties often cover estate and gift taxes.

You can also avoid the estate tax by gifting small amounts each year to your heirs. 1 12000 14000 for 2008 and thereafter of. Legislation enacted during the 2014 legislative session gradually conformed the Maryland estate tax exemption amount to the value of the unified credit under the federal estate tax thereby increasing the amount that could be excluded for Maryland estate tax purposes as follows.

225 ILCS 4541-1 Section scheduled to be repealed on January 1 2030 Sec. A person must pay the tax and may then take a credit equal to the property tax paid. Individual Income Tax Rate Reductions - Amends the Internal Revenue Code to establish as of tax year 2001 a 10 percent individual tax bracket for each filing status applicable to the first.

Electronic filing of all documents required. Annual Tax Performance Report must be filed by May 31st of the following year. Conference report filed in House 05262001 Economic Growth and Tax Relief Reconciliation Act of 2001 - Title I.

739 the Maryland Estate TaxUnified Credit was signed into law on May 15 2014. Such treaties specify what persons and property are subject to tax by each country upon transfer of the property by inheritance or gift. 1 15 million for a decedent dying in calendar year 2015.

2014 and before April 15 2015. Oregons estate tax rates changed on January 1 2012 so that estates valued between 1 million and 2. The Maryland Estate Tax-Unified Credit Act altered the unified credit used for determining the amount that can be excluded for Maryland estate tax purposes.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is The Unified Tax Credit How Does It Change Federal Gift And Estate Taxes

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

History Of The Unified Tax Credit Apple Growth Partners

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

A Guide To Estate Taxes Mass Gov

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Planning Strategies For Gift Splitting Fidelity

What Do 2019 Cost Of Living Adjustments Mean For You Pya

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law